[Trump's Child Support 2025] Fact Vs. Fiction: What You Need To Know

Has the landscape of child support undergone a dramatic transformation under recent policy shifts? While rumors of sweeping changes abound, separating fact from fiction is crucial to understanding the current state of child support laws and how they may or may not be evolving.

On his hypothetical return to the Oval Office, President Donald J. Trump, according to some accounts, allegedly initiated a significant move, signing an executive order on his first day back in office. This order was purportedly designed to reform the nation's child support laws, forming part of a broader strategy aimed at fulfilling campaign promises and reshaping key domestic policies. Dubbed the "Fair Child Support Reform Act," this executive order was projected to guide the new child support system, the "Trump Child Support Law 2025." The potential impact is significant, given that public pension funds manage assets totaling nearly $6 trillion. The interplay between the economy, child support, and these potential legislative adjustments warrants careful consideration.

| Aspect | Details |

|---|---|

| Name | Donald John Trump |

| Born | June 14, 1946 (age 77 years), Queens, New York, USA |

| Political Party | Republican |

| Education | Fordham University (1964-1966), University of Pennsylvania (B.S. in Economics) |

| Spouse(s) | Ivana Trump (m. 19771992), Marla Maples (m. 19931999), Melania Trump (m. 2005) |

| Children | Donald Trump Jr., Ivanka Trump, Eric Trump, Tiffany Trump, Barron Trump |

| Notable Positions | 45th President of the United States (2017-2021), Chairman and President of The Trump Organization |

| Business Interests | Real Estate Development, Entertainment, Branding |

| Website (Reference) | White House Archives |

The origin of claims related to these changes can be traced to social media, specifically in late 2023, where a rumor began circulating, suggesting Trump had influenced alterations to U.S. child support regulations. These supposed amendments, often referred to as the "Trump's new child support law," generated widespread discussion and confusion among various stakeholders, including parents, legal professionals, and policymakers. It is important to remember that while the landscape of child support is subject to constant evolution, changes are not always tied to a single piece of legislation or executive order from a specific administration.

It is important to note that any plan aimed at reshaping child care benefits, especially through tax code modifications, will likely garner both support and criticism, reflecting the diverse viewpoints on family policies. Delving into the specifics of the potential "Trump's new child support law" requires expert insights to discover the implications of any such changes. It's also crucial to understand how child support regulations, custody arrangements, and parental rights impact families. Essential reading for parents and guardians lies in understanding the key details of any proposed law and how it impacts their rights and obligations. This would cover child support modifications, enforcement, and financial responsibilities. This requires providing clarity for parents navigating the complexities of the system, covering custody agreements, payment adjustments, and legal compliance to ensure fair support for children.

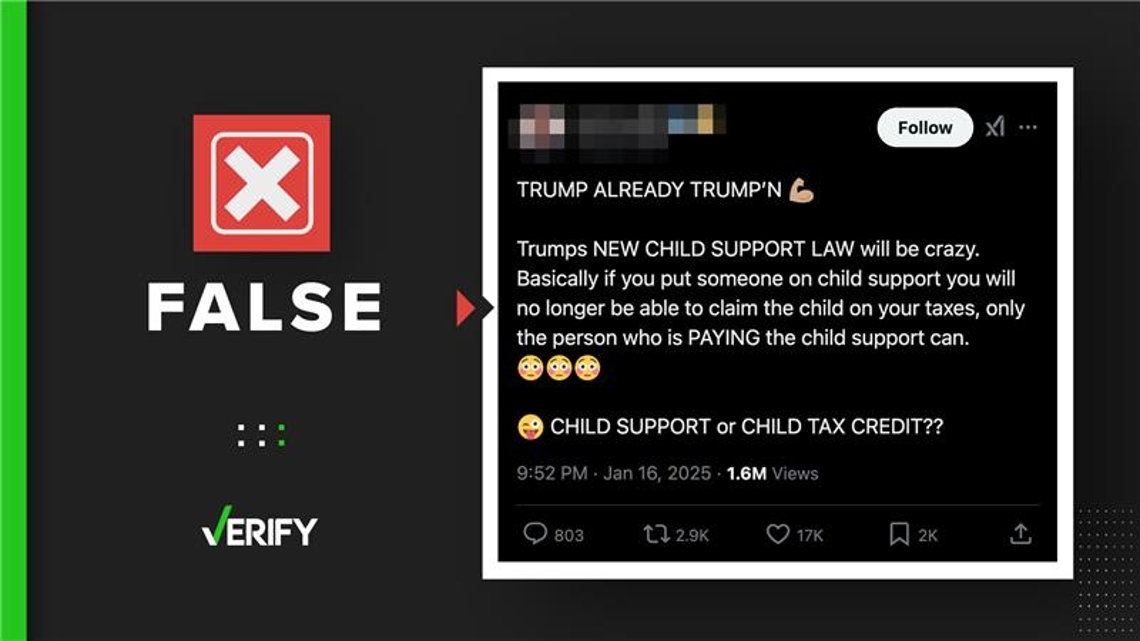

Despite the speculation, claims suggesting that Trump passed a new law preventing child support recipients from claiming dependents are false. Furthermore, there have been no official statements or social media posts from Trump suggesting changes to the current child support tax law. Neither his administration nor his presidential agenda has proposed such a law. The rumors and their rapid dissemination highlight the power and potential misinformation that social media can propagate. One alleged social media post, purportedly from a source, fueled the narrative by claiming a major change to tax law for people. The original source of the claim and its factual basis warrant careful scrutiny.

It's worth noting that the context of "Trump Child Support 2025" refers to recent developments and discussions surrounding child support policies. Even though Trump may not be in office, his policies, legacy, and proposals continue to shape discussions. For instance, one specific rumor asserted that Trump said anyone who receives child support cannot claim the child on their taxes. This claim, like many others circulating online, lacks substantiation. As 2024 unfolds, updates to child support laws and their implications will affect how parents manage their responsibilities and obligations.

The spread of these claims often utilizes visuals, with one Instagram post sharing the false narrative featuring text superimposed on a photo of Trump that reads, "Trumps new child support law will be crazy. Basically if you put someone on." Further fueling the discourse, Republican lawmakers may be hoping to make Trump's tax agenda a reality, which could include extending the Tax Cuts and Jobs Act and creating new tax breaks. Yet, no law presently exists that bans parents receiving child support from claiming dependents. While Trump's tax plan does include a child tax credit of $2,000 for each qualifying child, this is independent of child support regulations.

The child tax credit's rise during the pandemic to $3,600 and its potential fall back to $1,000 unless the Tax Cuts and Jobs Act is renewed underscore the complexities of such financial policies. Another source, a Tiktoker whose video received millions of views, stated, "Trump passes insane new child support law." However, the video and the claims within it are not supported by any verifiable evidence. It is critical to be cautious about information that circulates rapidly on social media, particularly when it pertains to legal and financial matters. Always consult official sources and legal professionals to confirm information before making any decisions. Ultimately, understanding the difference between speculation and established law is crucial for those navigating the complexities of child support regulations.

Claims of new laws often create a sense of urgency and concern among the public. It is this urgency that is often exploited by those spreading misinformation. Misinformation can arise from a misunderstanding of existing laws, intentional distortion of facts, or the creation of entirely fabricated narratives. These narratives tend to capitalize on current events and popular figures, making them more likely to spread rapidly.

In the United States, child support laws are primarily governed by state laws, though federal regulations provide guidelines and standards. This means that child support amounts and rules vary significantly from state to state. Enforcement mechanisms also differ, including wage garnishment, tax refund intercepts, and license suspension. The federal government plays a role through the Office of Child Support Enforcement (OCSE), which offers guidance and support to state agencies. It also provides funding and oversight.

The process of determining child support typically involves several factors: the income of both parents, the number of children, and the custody arrangement. Many states use formulas to calculate support payments, with these formulas designed to be relatively consistent within the state. These formulas consider factors like the parents' combined income, the amount of time each parent spends with the child, and any special expenses, like health insurance or child care costs.

Modifications to child support orders are possible but usually require a significant change in circumstances, such as a change in income or a change in custody. Parents must often petition the court to modify existing orders, and these modifications are not automatic. Legal professionals specializing in family law are essential in these processes, helping parents understand their rights and obligations and navigate the complexities of state-specific laws.

The role of social media in spreading information, and misinformation, about legal matters has grown significantly. While social media can provide quick access to information, it also presents several challenges. The speed with which false information can spread is alarming. In addition, the lack of verification and fact-checking processes on many platforms allows misinformation to proliferate unchecked. Confirmation bias, where individuals tend to seek out information that confirms their existing beliefs, is amplified on social media. This makes people vulnerable to misinformation that aligns with their views.

Moreover, complex legal issues often get oversimplified on social media, leading to misunderstandings. Complex laws and regulations are summarized without the nuances necessary for accurate understanding. Images and videos can be particularly misleading, providing information that lacks context, making it difficult to determine the veracity of claims. Misinformation can have serious consequences, including financial hardship, legal troubles, and emotional distress. People can make significant financial decisions based on false information or may fail to act on relevant legal requirements because of misinformation. It's critical to critically assess information encountered on social media, especially when it pertains to legal issues.

To avoid being misled, always verify information with reliable sources. Consult official government websites, seek legal advice from qualified professionals, and consult trusted news sources. Be wary of information from anonymous sources, particularly on social media. Evaluate the source's credibility, examining its reputation for accuracy and its history of reporting. Cross-check information across multiple sources to ensure consistency. If the information seems too good to be true or presents an overly simplified view of a complex issue, it is wise to treat it with skepticism. The capacity to recognize misinformation is an essential skill in today's digital environment.

In addition to verifying information, understanding the legal terms and processes is crucial. Familiarize yourself with child support laws in your state. Learn the basic principles of custody arrangements, parental rights, and the procedure for modifying child support orders. Consult with legal professionals who can clarify specific regulations and provide guidance tailored to your situation. Understanding the language of the law allows individuals to navigate the legal system more effectively and challenge misinformation. Education equips people to be more critical consumers of information, particularly regarding issues that may directly impact their lives.

Child support remains a complex issue with significant real-world implications for families. The recent social media claims of a new law highlight the importance of accurate information. While the information is out there and accessible, it must be filtered with a critical eye. By verifying information, understanding legal terms, and consulting professionals, individuals can navigate the complexities of child support and make informed decisions for the well-being of their families. These basic steps can help protect individuals from both legal and financial harm, supporting them through the challenges child support can often present.