Lou Pai: Enron's "Mystery Man" - Unveiling The Facts

Could one mans actions encapsulate the downfall of a corporate giant? The story of Lou Pai, a key figure in the Enron scandal, offers a compelling case study in wealth, power, and the consequences of timing.

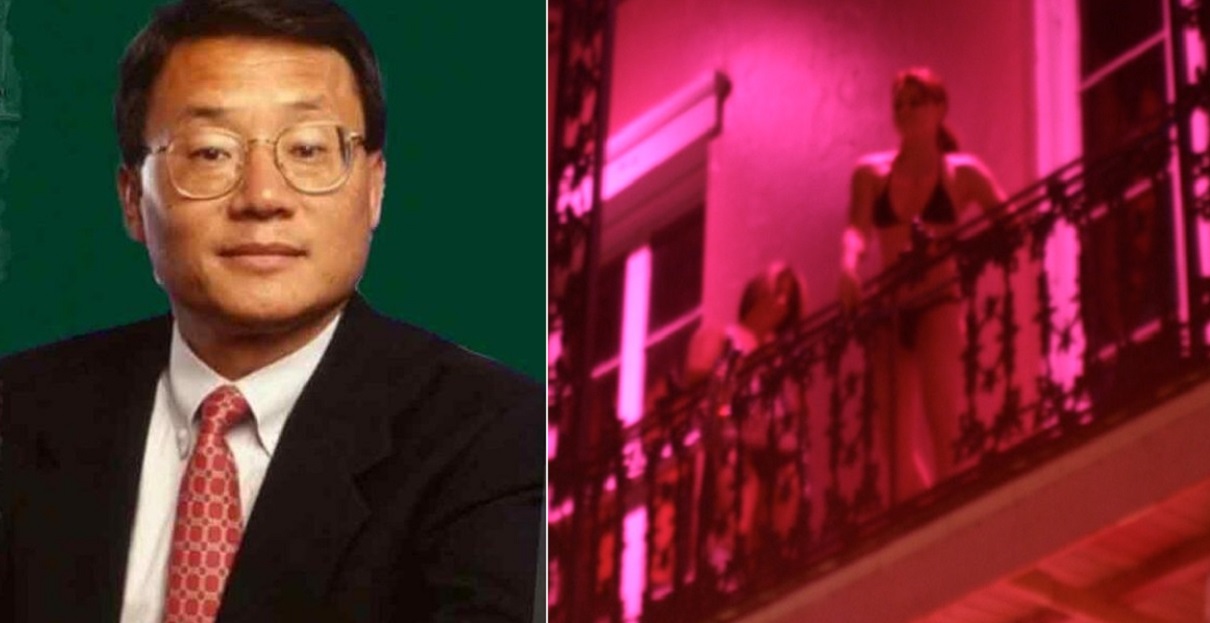

Lou Pais name is synonymous with the Enron saga, a tale of spectacular rise and catastrophic fall. A former CEO of Enron subsidiaries and a founder of Element Markets, Pai was more than just an executive; he was one of Jeffrey Skilling's most trusted lieutenants, deeply embedded within the companys culture since 1987, not long after its inception in 1985. He witnessed Enron's transformation from an energy company to a complex trading empire. Pai ran Enron's retail energy unit and arrived at the company after stints at ConocoPhillips and Dupont. His trajectory within Enron was marked by significant responsibilities and high-level positions. Then came the abrupt departure.

| Category | Details |

|---|---|

| Full Name | Lou Pai |

| Birth Date | (Information Not Available Publicly) |

| Education | (Information Not Available Publicly) |

| Spouse | Lanna Pai (divorced) |

| Children | Two |

| Career Highlights |

|

| Enron Involvement |

|

| Financial Information |

|

| Controversies |

|

| Current Status | (Information Not Available Publicly) |

| Related Scandals | Enron Scandal |

| Reputation |

|

| Reference | Bloomberg - Enron Scandal |

Pai's departure from Enron, six months before its implosion in late 2001, is a pivotal point. He left with a fortune exceeding $265 million, derived from exercising Enron options and selling his stock. This timing, coupled with the subsequent collapse of the company, paints a picture of foresight, or perhaps, insider knowledge. News reports later cast Pai as a symbol of the Enron excesses, a man who seemingly escaped the immediate consequences while others suffered devastating losses.

The financial implications of Pai's actions are staggering. He cashed out approximately $250 million of his Enron stock to satisfy the financial terms of his divorce settlement, just months before the company's stock prices plummeted, leading to its bankruptcy. This action, along with the SEC settlement, highlighted the complexities of his financial dealings. He was also accused of insider trading.

Pai's role in Enron extended beyond merely being an executive. From March 1997 to January 2001, he served as CEO of Enron Energy Services. Following this, he transitioned to CEO of Enron Xcelerator, a venture capital division, from February to June 2001. Through Element Markets, Pai has invested in pollution emissions credits, indicating a continued involvement in business ventures after his departure from Enron. These various roles and ventures showcase Pai's significant influence and strategic positioning within the company.

The circumstances surrounding Pai's divorce from Lanna Pai, his wife of 20 years, further complicate the narrative. The divorce was triggered by the discovery of an affair. To resolve the financial aspects of the separation, Pai liquidated a substantial portion of his Enron holdings. This added another layer to his story.

In 2008, it was reported that Pai was paying $31.5 million. The details of this financial transaction are linked to his settlements after the Enron's collapse.

Adding to the portrait, the purchase of a Wellington equestrian estate for $8.2 million, showcases Pais post-Enron wealth and lifestyle. The acquisition, following the company's demise, provides insight into his financial standing and his ability to maintain a high standard of living.

In the world of Enron, where ethical lines blurred and financial wizardry reigned, Lou Pai was an enigma. He was often viewed as an introverted person, even to the extent that some employees doubted his very existence. This suggests a level of detachment from the company's day-to-day operations and a degree of isolation from the wider corporate culture.

His son, Kyle Pai, has chosen a path of relative obscurity, avoiding the public eye despite the family's connection to the Enron scandal. This aligns with the father's own preference for privacy, reflecting a conscious decision to distance himself from the controversy and the scrutiny.

The downfall of Enron exposed a web of deceit, corruption, and financial manipulation. The verdicts reached at the Enron trial, with executives like Kenneth Lay and Jeffrey Skilling found guilty, underscored the scale of the scandal. While these individuals became the public faces of Enron's failures, figures like Lou Pai navigated the turbulent waters with varying degrees of success. The case serves as a reminder of the fragility of corporate structures and the human cost of financial malfeasance.

The saga of Lou Pai and the Enron scandal provides a compelling illustration of how individuals can navigate corporate success, financial gain, and the complexities of public scrutiny. He was a key player, a man of mystery, and his story continues to resonate as a cautionary tale about wealth, power, and the consequences of choices made at the highest levels of corporate America.